Question:

Did standing in solidarity with ‘Black Lives Matter’ help or hurt publicly traded companies in the USA?

Purpose:

George Floyd’s murder prompted an international outcry denouncing police brutality and white supremacy. Unlike previously recorded police murders and violence against black people, this death prompted big corporations to make public statements along with donations to support organizations against racism and injustices. As the Junior Economist, I was very interested in exploring the stock prices of the companies who pledged their support of ‘Black Lives Matter’ and how this has affected their perceived value.

Steps:

To explore this empirically, I decided to use R to compare stock prices of publicly traded companies from the date George Floyd was murdered until June 10th (the day I wrote this). I separated the companies by those who made donations and those who made statements. When making this list, I used parent companies of some subsidiaries and the data that was available through R’s ‘getSymbol‘ function.

The R code to reproduce these results can be found here!

Donators

Nike (NKE)

UnitedHealth Group (UNH)

Comcast (CMCSA)

Verizon (VZ)

Facebook (FB)

Amazon (AMZN)

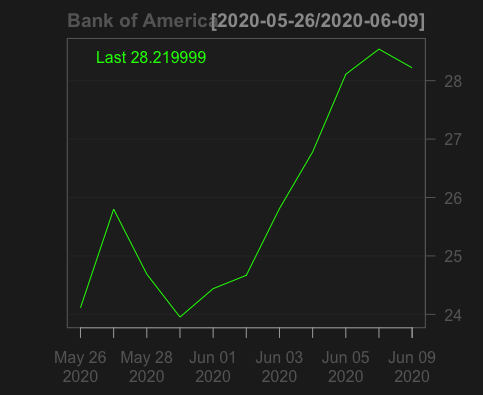

Bank of America (BAC)

Disney (DIS)

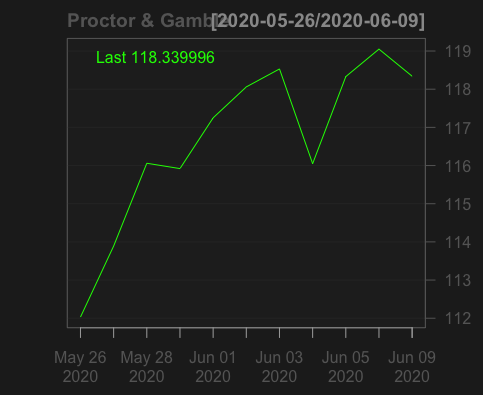

P&G (PG)

Lyft (LYFT)

Lululemon (LULU)

Pokemon Company (NTDOY)

Sequoia Capital (SEQUX)

Alphabet (GOOGL)

Electronic Arts (EA)

McDonald’s (MCD)

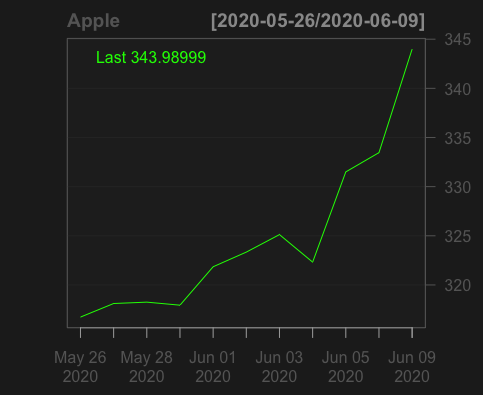

Apple (AAPL)

Slack (WORK)

Away (AWAY)

Uber (UBER)

Cisco (CSCO)

Intel (INTC)

Shopify (SHOP)

WeWork (WE)

Gap Inc. (GPS)

Etsy (ETSY)

Louis Vuitton Moet Hennessy (LVMUY)

Peloton (PTON)

Statements

Ben & Jerry’s (BJICA)

Twitter (TWTR)

Yum Brands (YUM)

ViacomCBS (VIAC)

Warner Brothers (TWX)

GM (GM)

Starbucks (SBUX)

Sony (SNE)

Microsoft (MSFT)

SnapChat (SNAP)

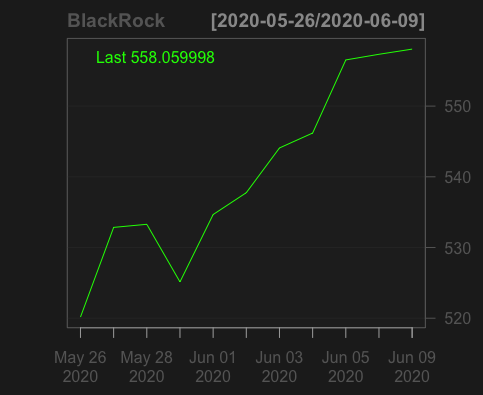

BlackRock (BLK)

Results

Public companies that have made/pledged public donations to the ‘Black Lives Matter’ Movement

Public companies that have made statements in solidarity with the ‘Black Lives Matter’ Movement

After refining the R code and reviewing each graph, the results were somewhat surprising. Most public companies that stood in solidarity with the ‘Black Lives Matter’ movement faired better than they originally started before George Floyd’s death went mainstream. However, Shopify and Slack were two companies that were not as lucky. Both tech companies initially rose, then had a steady decline, and as of June 10th have decreased below their lowest price, which was recorded on May 25th. Moreover, 1/3rd of the companies that donated experienced very tumultuous climbs which include: Intel, Facebook, Bank of America, Disney, Lyft, Nintendo, Uber, Gap, and Google. The same thing was observed by 3 companies who made statements, which include Twitter, General Motors, and Starbucks.

Conclusion

When big corporations decided to give their support to ‘Black Lives Matter’, they took a bold stance and a possible blow to their bottom line. However, all companies that decided to take acknowledge racial injustices gained more favorability through pricing in the stock market, even if it was just for a few days. This begs the questions of, “Do Big Corporations care, or is this interest convergence to protect their black dollar?”, which can only be answered through an analysis of their future C-Suite diversity, and their annual reports.

——————————————————————————

The Junior Economist would love to hear your thoughts on this, please feel free to add to the conversation through comments!

Follow the Junior Economist:

http://thejunioreconomist.com

Instagram: @TheJuniorEconomist

Twitter: @TheJrEconomist

Listen via Stitcher, Apple, Spotify, or wherever you get your podcast.